direct tax in malaysia

6 to 30 characters long. Introduction to Monthly Tax Deduction MTDPCB - Part 1 of 3 10th Aug 2022 80 Work Productivity Ideas Tips Activities for the Hard Workers 29th Jul 2022 Talenox Updates Q2 2022.

Ministry Of Finance And Economy Income Tax

Taxpayers or by foreign entities in which US.

. Exports in Malaysia increased to 14133420 MYR Million in August from 13407390 MYR Million in July of 2022. Income up to INR 25 lakhs No Tax. You can claim tax back on some of the costs of running your businesswhat HMRC calls allowable expenses.

110 of 2010 Direct Taxes Code 2013. 2022-9-15Meanwhile Indonesia set its crude palm oil reference price for the Sept. Intramuros Manila 1002 PO.

Malaysias foreign direct investment dropped to MYR 173 billion in Q2 of 2022 from MYR 244 billion in Q1 amid the impact of both COVID-19 disruptions and the war in Ukraine while still marking the seventh straight quarter of net inflow. Weve combined sophisticated automated aggregation technologies with direct editorial input from knowledgeable human editors to present the one indispensable narrative of an industry in. Foreign Direct Investment in Malaysia averaged 806143 MYR Million from 2005 until 2022 reaching an all time high of 2469041 MYR Million.

50 lakhs and Rs. What do I do. This website contains information links images and videos of sexually explicit material collectively the Sexually Explicit Material.

Other Direct Tax Rules. Governments use the organization to establish revise and enforce the rules that govern international trade. Income between INR 25 lakhs-INR 5 lakhs.

2022-5-7What is Foreign Direct Investment FDI. How you can reduce your tax by claiming on business expenses. You can check your road tax delivery status via the following method.

I you are not at least 18 years of age or the age of majority in each and every jurisdiction in which you will or may view the Sexually Explicit Material whichever is higher the Age of Majority ii such material offends. 1 day agoThe World Trade Organization WTO is an intergovernmental organization that regulates and facilitates international trade. For the most part individuals who stay in Malaysia for at least 182 days or more in a calendar year are.

Muralla cor Recoletos Sts. Budget and Bills Finance Acts. Online via MyEG website here.

As a sole trader or freelancer its crucial to understand your basic allowable expenseseven if youre paying an accountant to help with your tax return. 2022-10-10Mediagazer simplifies this task by organizing the key coverage in one place. An entity which provides insurance is known as an insurer an insurance company an insurance carrier or an underwriterA person or entity who buys insurance is known as a policyholder while a.

Custom Payroll Report and more. 2022-10-8Insurance is a means of protection from financial loss. Lasting interest differentiates FDI from foreign portfolio investments where investors passively hold securities from a foreign country.

22 hours agoIncome Tax Slab. 1 day agoChartered Tax Institute of Malaysia Registration Number. Treatment by private doctors is also paid by the government when the doctor direct bills the Health Department Bulk Billing.

On June 2 the President approved amendments to the Tax Code providing tax benefits to businesses affected by the COVID pandemicAzN 012 bn or 02 percent of GDP. Checkout our mobile app for latest deals. Checkout MH Mobile App for latest deals.

It officially commenced operations on 1 January 1995 pursuant to the 1994 Marrakesh Agreement thus replacing the General. 10 of the income tax where the aggregate income is between Rs. 16 to 30 period at 84632 per tonne a Trade Ministry regulation showed down from 92966 per tonne for the first half.

In different parts of the world a marketplace may be described as a souk from the Arabic bazaar from the Persian a fixed mercado or itinerant tianguis or palengke PhilippinesSome markets operate daily and. 603-9212 7848 Email. 199101015438 225750-T B-13-2 Megan Avenue 2 No12 Jalan Yap Kwan Seng 50450 Kuala Lumpur Malaysia Tel.

ASCII characters only characters found on a standard US keyboard. 15 of the income tax where the aggregate income is. FFIs are encouraged to either directly register with the IRS to comply with the FATCA regulations and FFI agreement if applicable or comply with the FATCA.

1 day agoMalaysia Airlines is the national carrier of Malaysia offering the best way to fly to from and around Malaysia. Exports in Malaysia averaged 2913488 MYR Million from 1970 until 2022 reaching an all time high of 14602630 MYR Million in June of 2022 and a record low of 32810 MYR Million in February of 1970. Monday through Saturdays 8am 5pm.

Both resident and non-resident taxpayers are taxed only on income accrued in or derived from within Malaysia. Sales and Service Tax Malaysia Airlines Berhad Reg. Taxpayers hold a substantial ownership interest.

This page provides the latest reported value for - Malaysia Exports - plus. 632 8527-8121 All departments HOURS. Must contain at least 4 different symbols.

2022-10-8A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer an individual or legal entity by a governmental organization in order to fund government spending and various public expenditures regional local or national and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right. Do NOT continue if. Resident status and income tax in Malaysia.

The amendments grant a one-year exemption from land and property tax to selected sectors including tourism passenger road transportation and cultural facilities. Find IHGs best hotels worldwide using our hotels and destinations explorer. Call MyEG customer service at 6037801 8888.

1 day agoAll legal permanent residents are entitled to government-paid public hospital care. 1 day agoThe Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards. Medicare is funded partly by a 15 income tax levy with exceptions for low-income earners but mostly out of general revenue.

Direct Taxes Code 2010 Bill No. Income higher than INR 10 lakhs. FATCA requires foreign financial institutions FFIs to report to the IRS information about financial accounts held by US.

22 hours agoIve renewed my car insurance with road tax renewal online with AIG. Foreign direct investment FDI is an investment from a party in one country into a business or corporation in another country with the intention of establishing a lasting interest. Income between INR 5 lakhs-10 lakhs.

Call AIG Malaysia to enquire further at 1800 88 8811. It is a form of risk management primarily used to hedge against the risk of a contingent or uncertain loss. You can browse by location or by interest.

I havent receive my road tax as per expected delivery date. 2022-10-9A marketplace or market place is a location where people regularly gather for the purchase and sale of provisions livestock and other goods. 2021-12-62022 Tesla Model 3 in Malaysia priced from RM289k tax free PEKEMA aims to sell 500 Tesla EVs per year In Cars Local News Tesla Motors By Anthony Lim 6 December 2021 829 pm 54 comments.

What Are The Sources Of Revenue For Local Governments Tax Policy Center

Types Of Taxes The 3 Basic Tax Types Tax Foundation

Pdf Tax Simplicity And Small Business In Malaysia Past Developments And The Future Semantic Scholar

Pdf The Effect Of Tax Knowledge Compliance Costs Complexity And Morale Towards Tax Compliance Among Self Employed In Malaysia Semantic Scholar

Solved Required Discuss In Detail All The Various Types Of Chegg Com

What Is The Difference Between The Statutory And Effective Tax Rate

Ppt Tutorial 1 Introduction To Income Tax Law Powerpoint Presentation Id 3473088

Malaysia Personal Income Tax Rate 2022 Data 2023 Forecast 2004 2021 Historical

Overview Of Tax System In Malaysia Gelifesavers

Malaysia Payroll And Tax Activpayroll

Pdf Have Taxes Led Government Expenditure In Malaysia Semantic Scholar

Taxation In New Zealand Wikipedia

Impacts Of The Self Assessment System For Corporate Taxpayers

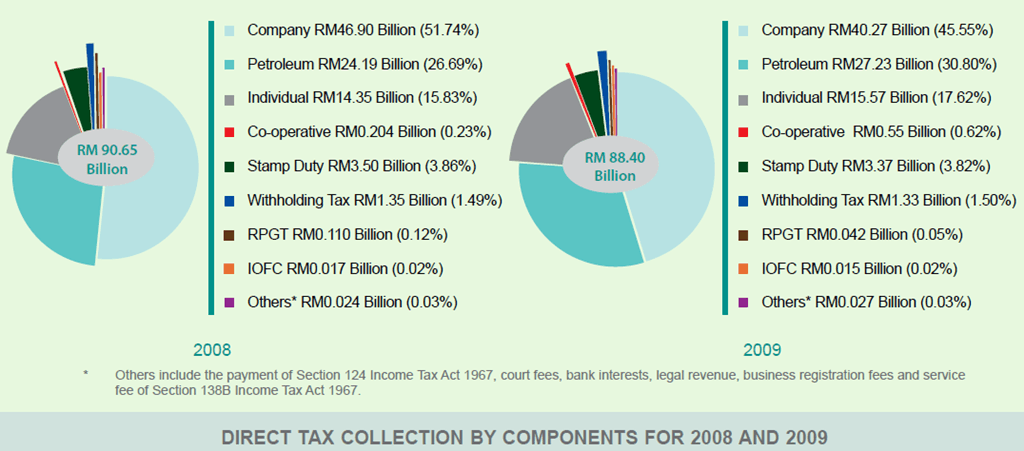

Malaysia Direct Tax Revenue Collections For 2009 Tax Updates Budget Business News

Prometrics Finance Computation Of Income Chargeable To Tax Adjustments To The Profit And Loss As Per Books Icds

Why It Matters In Paying Taxes Doing Business World Bank Group

Sme Corporation Malaysia Books Tax Incentives For Smes In Malaysia

Comments

Post a Comment